green card exit tax amount

You are a long-term resident which means you have held a green card in at least 8 of the previous 15 years IRC 877 e 2 877A g 5. A long-term resident is defined as a lawful permanent resident in at least 8 of the 15 years period ending with the expatriation year.

Green Card Exit Tax Abandonment After 8 Years

Tax evasion and conspiracy to defraud.

. If you work from a company that withholds income taxes from your check then you should file a tax return. Different rules apply according to. Green card taxes are required for green card holders.

To calculate any exit tax due to the US person for surrendering a Green Card an IRS Form 8854 is used. Your risk exists if. Failure to file a tax return as a green card holder is punishable by fees of 5 of the total owed balance of taxes compounding up to 25 for continued failure to pay.

Green card holders may be subjected to the exit tax rules when they. US Citizens are not the only people required to pay taxes to the US. For example if you got a green card on 12312011 and.

Resident status for federal tax purposes. The amount is not indexed for inflation. The expatriation tax consists of two components.

These are Five important factors to keep in mind before you begin the process. Citizens or long-term residents. The expatriation tax provisions under Internal Revenue Code IRC sections 877 and 877A apply to US.

You cease to be a lawful permanent. The general rule is for US Green Card holders who have been in the US for 8 of the last 15 years or more with assets less than around 2 million they should escape any taxation. Also send a copy of your Form 8854 marked Copy to the address under Where To File later.

Giving Up Your Green Card or US Citizenship Can Be Costly. About Our International Tax Law Firm. The Exit Tax is computed as if you sold all your assets on the day before you expatriated and had to.

Underpayment of taxes can result in fees ranging from 20-40 of owed taxes depending on the circumstances and severity of the underpayment. Currently net capital gains can be taxed as high as 238. If you are covered then you will trigger the green card exit tax when you renounce your status.

Then they must determine the FMV on the day. Exit tax implications of the treaty election. Citizenship or long-term residency by non-citizens may trigger US.

The three conditions which can trigger you to pay the dreadful exit taxes are. Permanent residents and green card holders are also required to pay taxes. If you make the election to be a nonresident of the United States for income tax purposes you risk triggering the exit tax.

Contents hide 1 Long-Term Resident. There are three. 6 Golding Golding.

The average annual net income that you are taxed on for the five years before you expatriate is more than a set amount. This is called the net. The amount of tax eligible for deferral on Section D line 4 is 575000.

The expatriation tax rule only applies to US. For Green Card holders to be subject to the exit tax they must have been a lawful permanent resident of the Unites States in at least 8 taxable years during a period of 15 taxable years ending with the taxable year during which the expatriation occurs when you give back your green card. Attach your initial Form 8854 to your income tax return Form 1040 1040-SR or 1040-NR for the year that includes your expatriation date and file your return by the due date of your tax return including extensions.

A green card holder must have been a lawful permanent resident in eight of the 15 years ending with the year of expatriationin other words the green card holder is a long-term resident a defined term in the IRC. Government revokes their green card visa status. The exit tax and the inheritance tax Both may be triggered upon abandonment of citizenship or for non-citizens abandonment of a green card by a long-term resident.

It is the IRSs last chance to tax you. In this first of our two-part series we explain some of the. Note that the amount refers to net income any deductions that reduce your.

Abandon their green card status by filing Form I-407 with the US. Green card holders are also affected by the exit tax rules. The exit tax rules apply to individuals who are considered covered expatriates For an individual who gives up his or her citizenship or green card to qualify as a covered expatriate one of the following must also apply.

Citizens who have renounced their citizenship and long-term residents as defined in IRC 877 e who have ended their US. The individuals annual net income tax liability for the prior five years was greater than 145000 2010 amount or. The Exit Tax is computed as if you sold all your assets on the day before you expatriated and had to report the gain.

If you are neither of the two you dont have to worry about the exit tax. In order to determine if there is an exit tax. To put this simply if you held your Green Card for a.

Beware Exit Tax USA. The amount is adjusted by inflation 2018s figure is 165000.

Green Card Holder Exit Tax 8 Year Abandonment Rule New

American Express Green Vs Gold Vs Platinum Cnn Underscored

Usa Visa Template Immigration Document To United States American Green Card Mock Up Visa Card Numbers Green Card Usa Templates

Form I 551 Explained Boundless

Green Card Holder Exit Tax 8 Year Abandonment Rule New

Green Card Holder Exit Tax 8 Year Abandonment Rule New

Get A Green Card For Your Parents What You Need To Know 2019

The Green Card Is The Holy Grail Of Chinese Visas Here S How It Works Smartshanghai

Beware Exit Tax Usa Giving Up Your Green Card Or Us Citizenship Can Be Costly

Us Tax Residency Status Explained Resident Or Nonresident

Form I 551 Explained Boundless

How To Get A Green Card Without Marriage Employment And Investment

Green Cards Benefits Obligations And Disadvantages

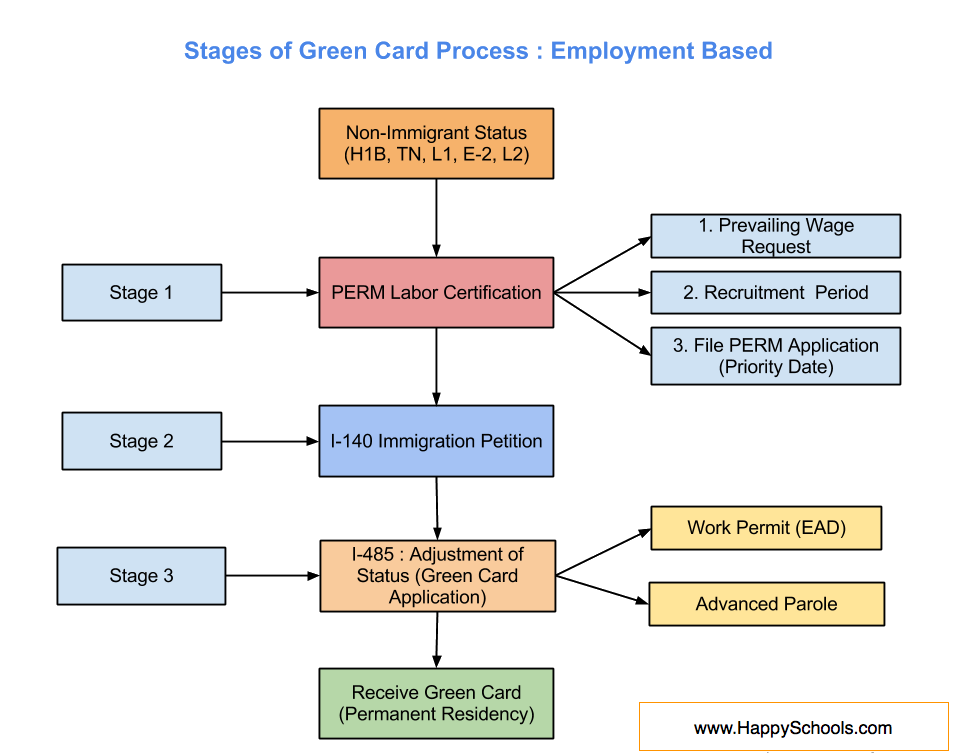

3 Steps Green Card Process Explained For Eb1 Eb2 Eb3 Eb5

Can I Travel With A Green Card And No Passport Ashoori Law

Go Green Card Holders Pay Taxes On Foreign Income

Exit Tax For Renouncing U S Citizenship Or Green Card H R Block

Get A Green Card For Your Parents What You Need To Know 2019